WE’RE HELPING COMMUNITIES HELP PEOPLE

By reimagining software for the enrollment, administration, and reporting of government funded programs

Software Solutions for Government Funded Programs

HOW CAN WE HELP?

How do we best fit your needs today?

Housing Choice Voucher Software

I WANT A BETTER SOFTWARE PLATFORM FOR MY HOUSING CHOICE VOUCHERS PROGRAMS

Housing & Community Development Software

I NEED A SOFTWARE TOOL FOR HOUSING & COMMUNITY DEVELOPMENT PROGRAMS

HOME Energy Rebates Software

I NEED AN EFFICIENT SYSTEM OF RECORD TO MANAGE MY STATE'S HOME ENERGY REBATES PROGRAM

Disaster Recovery & Mitigation Software

I NEED SOFTWARE TO MANAGE MY DISASTER RECOVERY & MITIGATION PROGRAM

More than just great software

COMMUNITY IMPACT

Neighborly Software was built to help communities make a difference in the lives of low-income families and vulnerable populations.

581+ neighbors (clients)

7.4M+ applicants

2705+ projects

$12.7B+ disbursed through our system

Housing & Community Development

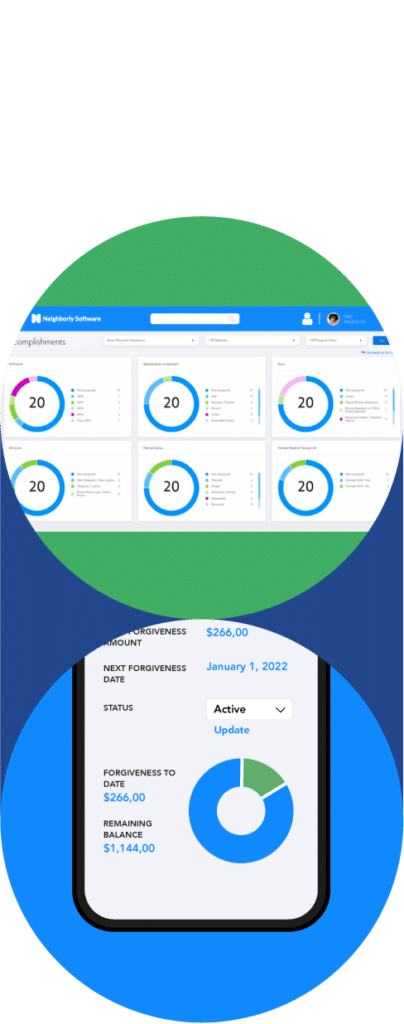

The Market Leaders for HCD

Over 30% of all jurisdictions in the US use Neighborly Software to manage their housing & community development programs.

Our platform administers 20+ HCD activities with a software solution specifically designed for the public sector.

Housing Choice Vouchers

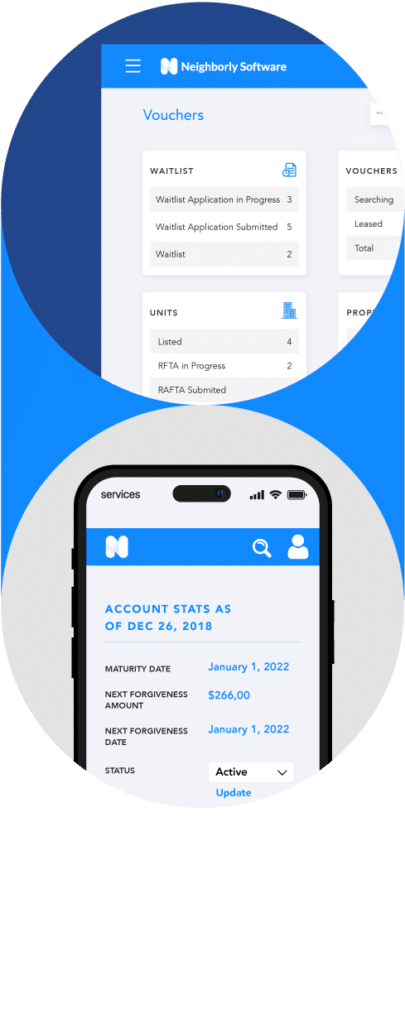

A revolutionary HCV platform

Our newest product, Neighborly Software HCV platform, was built from the ground-up alongside industry experts, thought leaders, and housing authorities.

We set out to change the reality of Traditional HCV software from clunky, bureaucratic, and difficult to navigate to a simple, clean interface that is easy to use, and prioritizes your needs.

Disaster & Recovery Mitigation

THE FASTEST GROWING DISASTER RECOVERY SOFTWARE ON THE MARKET

Help your community recover from natural disasters by administering all CDBG-DR and CDBG-MIT activities within a single software solution.

When disaster strikes, you need to act fast. Neighborly Software’s cloud-based platform can be launched quickly, allowing accelerated disbursement of funds to folks who need it most.

City of Fort Worth